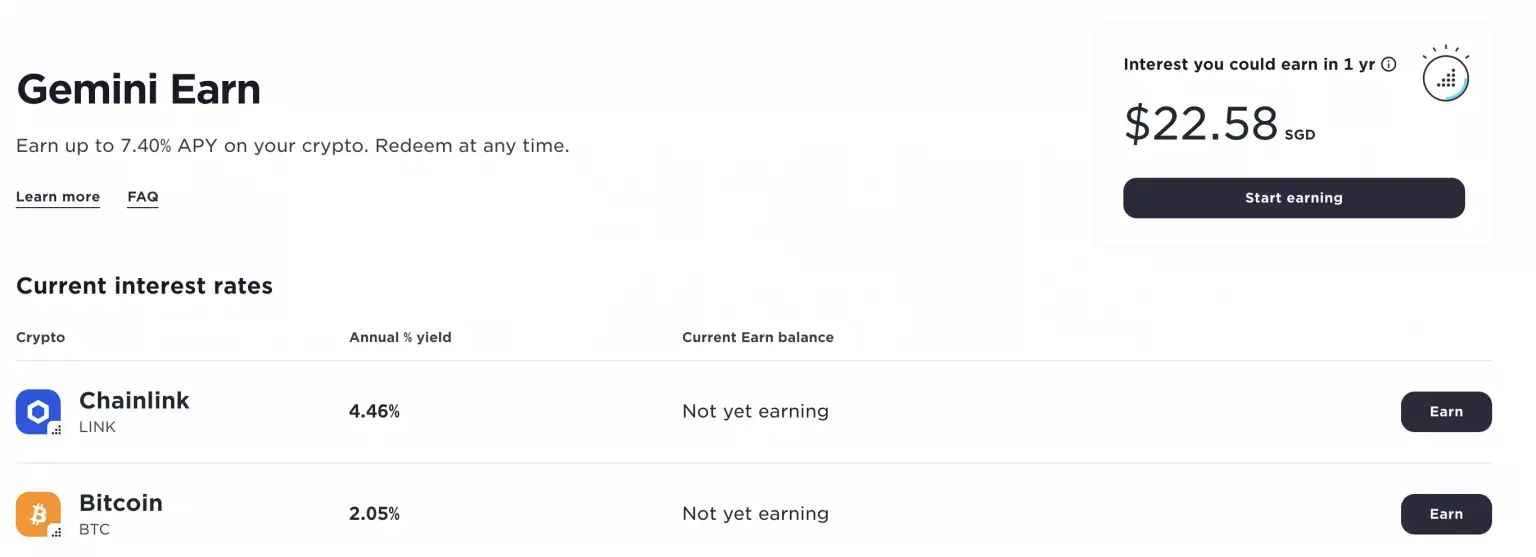

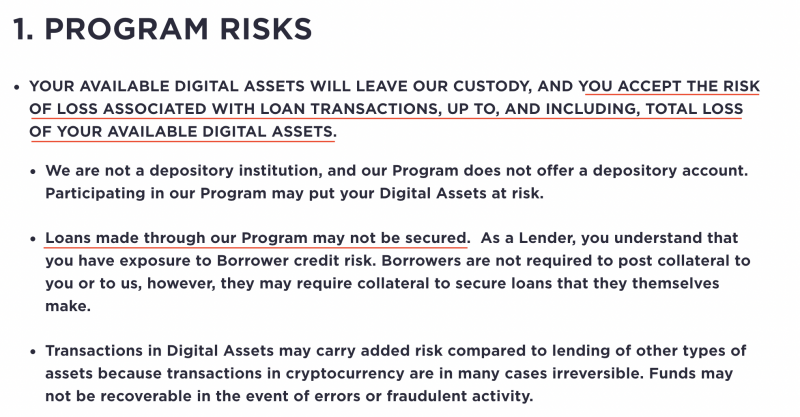

Genesis would send interest payments to Gemini, who would then deduct an “agent fee” before distributing the remainder of the interest payments to its clients. Genesis would earn revenue by lending the crypto assets at a higher rate than it paid to clients of the Gemini Earn Program. Genesis pooled together the crypto assets from clients of the Gemini Earn Program with the assets of other clients and would then lend these crypto assets to institutional borrowers. To participate in this program, clients were required to enter into a tri-party Master Digital Loan Agreement with Genesis and Gemini whereby clients provided crypto assets to Genesis, with Gemini acting as the agent in the issuance. The Gemini Earn Program permitted retail clients to earn interest on certain crypto assets. This enforcement action also confirms that the SEC views crypto lending arrangements as falling within its regulatory jurisdiction and is willing to use its traditional enforcement remedies.

The step is consistent with enforcement proceedings brought by the SEC against crypto market participants generally and centralized crypto asset lenders in particular - as previously reported, in May 2022 the SEC announced that it would double the size of its Division of Enforcement’s Crypto Assets and Cyber Unit. In an action that is reflective of the commitment of the American Securities and Exchange Commission’s (the SEC) enforcement efforts against improper activity in the digital asset space, the SEC filed a complaint (the Complaint) against Genesis Global Capital, LLC (Genesis) and Gemini Trust Company, LLC (Gemini) on January 12, 2023, for allegedly engaging in the unregistered offering and sale of securities through the “Gemini Earn Program.”

0 kommentar(er)

0 kommentar(er)